Meet Dub, the App Revolutionizing Investing for Teens and Gen Z

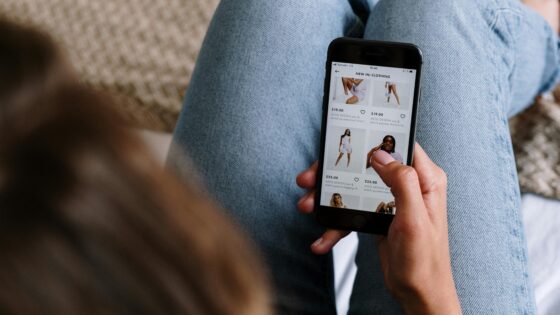

Imagine being able to copy the investment moves of your favorite influencers or even well-known politicians like Nancy Pelosi—all with a few taps on your phone. That’s what Dub, the innovative new investing app, allows users to do. It’s a fun and easy way for young people, especially teens, to learn about investing without having to pick individual stocks.

Dub was created by 23-year-old Steven Wang, a Harvard dropout who started investing as a kid. His idea? Instead of spending hours researching stocks, why not just follow the moves of expert investors? With Dub, you can do just that. It lets you copy the portfolios of top traders, hedge funds, and even politicians, giving you a chance to make the same moves they do.

Already, over 800,000 people have downloaded Dub, and the app has raised $17 million in funding. But what makes it so popular? For one, it’s simple. You don’t need to be an expert to start investing—just follow the people who know what they’re doing. Plus, Dub’s target audience is younger people, and it’s catching on fast with Gen Z.

In fact, after seeing Dub’s ads on Instagram, even this editor’s 15-year-old has asked about “investing like Nancy Pelosi.” While Pelosi isn’t actually on Dub, her trades are being mimicked by other investors on the platform. And apparently, the move is paying off—one of the portfolios copying Pelosi’s actions has seen a 123% return!

他のトレーダーのポートフォリオをコピー出来る投資アプリ「Dub」が$17M調達を発表した。

80万ダウンロードを突破したDubでは個人トレーダー、ヘッジファンド、政治家などのポートフォリオをすぐにコピーできる。

株ではなく人を選ぶコンセプトが面白い。https://t.co/gGmGy7LUXD pic.twitter.com/Yrw0mvjCo4

— Tetsuro Miyatake (@tmiyatake1) February 3, 2025

But while Dub is making waves in the world of social media-inspired investing, it’s not completely free. The app uses a $10-per-month subscription model. On top of that, some successful traders on the platform charge management fees, and Dub takes a 25% cut of those fees. But for users, it’s an opportunity to learn and earn by following people who are already successful.

Dub is also making sure it follows the rules. Unlike other fintech apps that have faced scrutiny, Dub spent over two years working with regulators to make sure it complies with financial guidelines. Wang believes that, in contrast to platforms like Robinhood, Dub isn’t just making trading easy but is also educating users on how to make smarter decisions.

The app shows important details like risk scores and stability metrics to help users make informed choices. Wang sees Dub as a safer option for investing, as it encourages people to understand what they’re doing rather than just “gambling” with their money.

Not everyone agrees with the idea of following others’ trades. Some critics argue that actively managed portfolios don’t outperform passive investing over time. But Wang is confident that following successful traders can pay off, pointing to the success of big hedge funds as proof that it’s possible to make money by copying the right strategies.

As Dub continues to grow and attract new users, it’s clear that the app is tapping into a trend where young people are increasingly eager to learn about and get involved in the world of investing. Whether it’s following top investors or learning from the success of popular figures, Dub is making investing feel accessible and less intimidating for a new generation.

Will Dub become the go-to app for young investors? It’s too early to say, but with its mix of social media flair and educational tools, it’s definitely a platform to keep an eye on.