Forgotten streaming services and unused apps could be draining thousands from your wallet each year without you even noticing

Quick question: Do you know exactly how many subscriptions are charging your bank account right now? If you’re struggling to recall it, trust me, you’re not the only one. Most of us have way more digital subscriptions than we think, and here’s the kicker. Many of them are services we haven’t used in months or maybe even years.

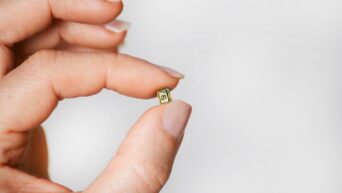

These sneaky little charges have a name. They’re called “zombie subscriptions,” and they’re quietly eating away at your money without you realizing it. Studies show that people waste hundreds or even thousands of dollars every year on these forgotten memberships. But here’s some good news. You can track them down and get your money back with just a little detective work.

What Exactly Are Zombie Subscriptions?

Think of zombie subscriptions as those recurring payments that just won’t die. You signed up for something ages ago, forgot all about it, but it keeps charging you month after month. The name fits perfectly because these subscriptions keep “living” in your bank statements even though you’re not getting any benefit from them.

We’ve all been there. You sign up for a streaming service to binge one show, then never cancel it. You download a meditation app full of motivation in January, but by March you haven’t opened it once. Or remember that free trial you started? It probably turned into a paid subscription without you even noticing.

Businesses have it worse. Companies can lose serious money on software nobody uses anymore. An employee leaves but their software license keeps renewing. Different team members buy the same tool because nobody knows someone else already has it. It adds up fast.

How to Hunt Down Your Zombie Subscriptions

Ready to find these money drains? Start by pulling up your bank and credit card statements from the last three months. Look for anything that charges you regularly. Could be monthly, could be yearly. Grab a notebook or open a spreadsheet and write down each subscription you find. Note how much it costs and be honest about when you last actually used it.

Here’s a smart trick most people miss. Search your email inbox. Type in words like “subscription,” “receipt,” “auto-renew,” or “welcome.” You’ll be amazed at what pops up. All those confirmation emails from services you totally forgot about will suddenly appear, showing you exactly where your money’s been going.

Taking Action to Save Money

Found your zombies? Great. Now it’s time to kill them off for good. The important part is canceling through the same place where you originally signed up. If you subscribed on your phone, check your app store settings. If it was on a website, log into that account and look for billing or subscription options.

And hey, don’t feel bad about asking for your money back. Seriously. If you’ve been charged recently for something you forgot about, contact the company and explain the situation. You’d be surprised how often they’ll refund you, especially if you haven’t been using their service. Even big tech companies do this pretty regularly.

Want to know how much you could save? Financial experts say most people can cut around two hundred dollars a month just by canceling stuff they don’t use. Do the math. That’s nearly twenty-five hundred dollars a year. Imagine what you could do with that extra cash instead of paying for apps gathering dust on your phone.

Preventing Future Zombie Subscriptions

You’ve cleaned house, but how do you keep new zombies from creeping back in? Set up some simple reminders. When you start a free trial, put a note in your calendar a day or two before it ends. That way you can decide if you really want to pay for it or cancel before the charges start.

Make it a habit to review your subscriptions every few months. Just a quick check to see if you’re still using everything. It takes maybe fifteen minutes but saves you from paying for things you don’t need.

If you live with family or roommates, talk about sharing subscriptions. Many services offer family plans that cost way less than everyone paying separately. You could split the cost and everyone wins.

We’re already into 2026, which makes this the perfect time to get your digital spending under control. Spend one hour this week going through your subscriptions. You might be shocked at how much money you find hiding in your bank statements. That forgotten gym app or streaming service you signed up for two years ago? They’ve been waiting for you to notice them. Time to show them the door.